Credits

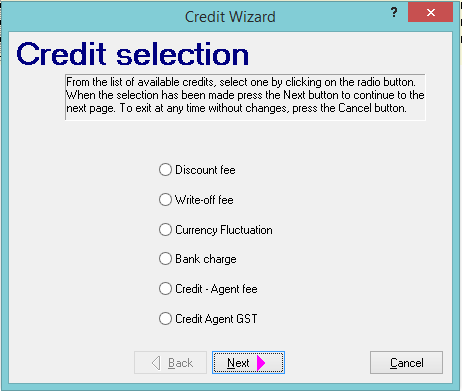

A credit is a payment that has not been received for an invoiced fee. The credit types in eBECAS/EDMISS are Discount fee, Write-off fee, Currency Fluctuation, Bank Charge and Credit - Agent fee.

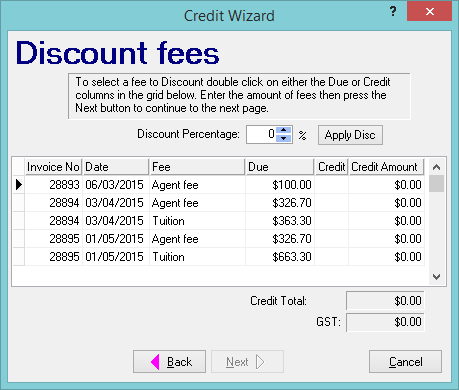

Discount Fees

A discount can be applied as a percentage or a fixed value. If a discount is applied to the tuition fee, then the same discount percentage value should be applied to the agent fee. If the fee includes a GST portion, the GST value will also be credited. A discount is typically a reduction in the charged rate. If you are to completely discount the fee, this would be better identified as a write-off.

Write-off Fees

Writing off a fee means that the fee is no longer due for payment. When a fee is written off, the intention is that the fee will not be received and will not be recovered. You can only completely write off the fee, otherwise you should be using discounting for a partial write-off. For example you can write off a enrolment fee. Note - there is a separate option to Credit an agent fee when you receipt the tuition portion (nett) and the agent keeps the commission - see below.

Currency Fluctuation and Bank Charges

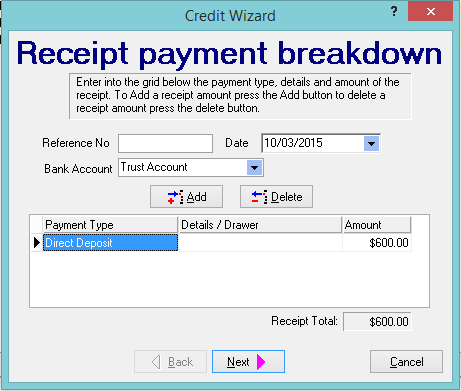

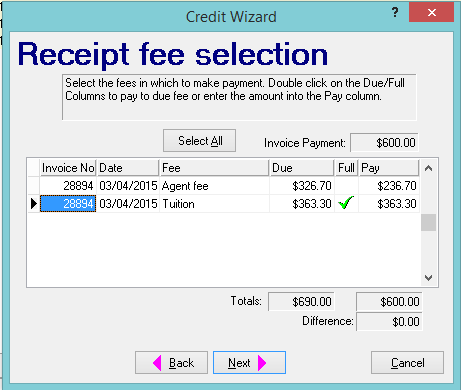

In eBECAS/EDMISS, we receipt by fee. Sometimes fees are not paid in their entirety due to currency fluctuation or bank charges. If this ever happens, you can identify the fee as no longer needing to be paid or as outstanding and still due. Below is an example of this, where the total outstanding student fees is $690 and the amount received via direct deposit is $600.

In the credit wizard, first enter the receipt amount.

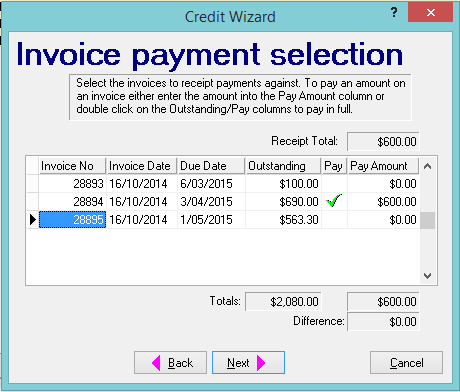

You must then specify the amount being paid and against which invoice (there can be multiple invoices to pay). You can only click the next button when the amount receipted matches the total paid against the invoice(s).

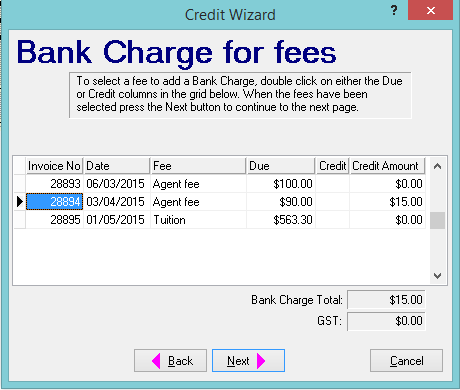

We recommended you assign the outstanding fee against a non-course fee (not related to tuition and agent). In this example, an outstanding $15 is added to the Agent fee.

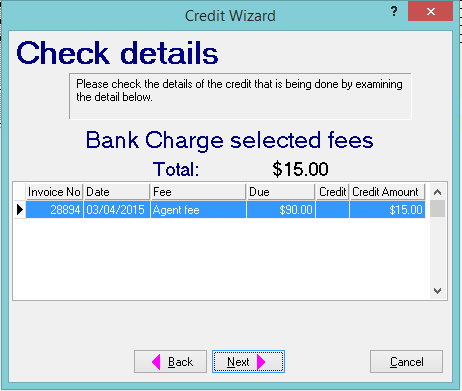

Press next and finish to display the updated fees tab in the Enrolment details.

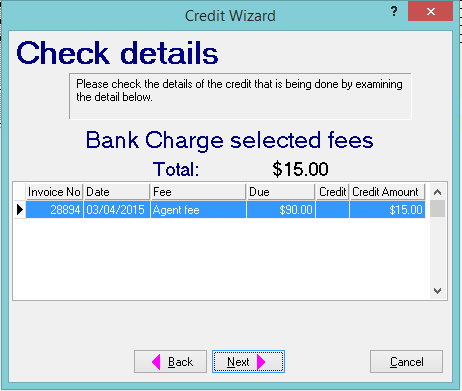

The outstanding $15 will need to be identified as a bank charge. To do this, select credit from the left hand panel, and then select Bank charge.

Select next to view the below screen:

Select next again.

Credit Agent fee

In eBECAS/EDMISS, the course cost is always listed as the gross fee, which is what the student pays. This is specified for each Course from Main - Utilities - Courses.

The course cost is always displayed as two separate items: tuition fee and agent fee (commission). The course cost therefore = tuition fee + agent fee.

Agent commissions are a fixed value or percentage of course cost. Agent commissions are specified in the agent section Main - Agent - Agent Details - Commission. You can have different commission rates for each agent by faculty (grouped courses).

An offer is a pro-forma invoice. You can use Microsoft Word templates to generate pro-forma invoices. If a pro-forma invoice is sent to an agent, then the course cost is usually shows the agent commission. You can have several templates displaying pro-forma invoices gross or nett. Usually a pro-forma invoice is also sent to the student, displaying only the total course cost with no agent fee displayed.

The display of course fees in the Enrolment Fees screen, shows separate tuition and agent fees, never the less you can print the pro-forma invoice nett or gross. Please wait until the tuition fee is paid to verify if the commission is credited or receipted. Our experience is that while you may invoice nett, the agent could still pay gross. We encourage Colleges to wait until the tuition and/or agent fees are received before crediting the agent fee. To correctly print the gross receipt of a nett fee payment the date of the tuition payment must always be the same date as the credit of the agent fee.

Please do not credit the agent fee until you receive the tuition fee payment. The date the tuition fee is paid (if paid nett) should also be the date the agent fee is credited.

Credit Agent fee GST

In eBECAS/EDMISS, Agent commissions should include the agent invoiced GST.

In the agent details, if the agent is local to Australia, then the agent should be marked as local their ABN number should be added.

The commission rate should include the GST component. If the standard commission rate is 20% and the College agrees to pay the additional 10% GST on top of the commission, then the rate should be 22%. This is the percentage of the course cost you have agreed to let the agent keep. We suggest that to avoid confusion, colleges have a separate Microsoft Word template for local agents that includes a line specifying that the GST is included and needs to be forwarded to the tax office. You need to be aware of what GST you have paid, this can be accessed in the invoices and by viewing the 'Debits in period' reports.