Financial Reports

There are reports that can be printed and exported to spreadsheet (menu items under eBECAS/EDMISS - Reports) and also "reports" that are viewed in a displayed grid (menu items under eBECAS/EDMISS - Main).

eBECAS/EDMISS - Main - Finance

Grid searches and display enable you to select the columns you are interested in viewing and enable you to group and total flexibly. You can apply filters and complex queries in the grid for multiple columns. All grid displays have the option to export to spreadsheet.

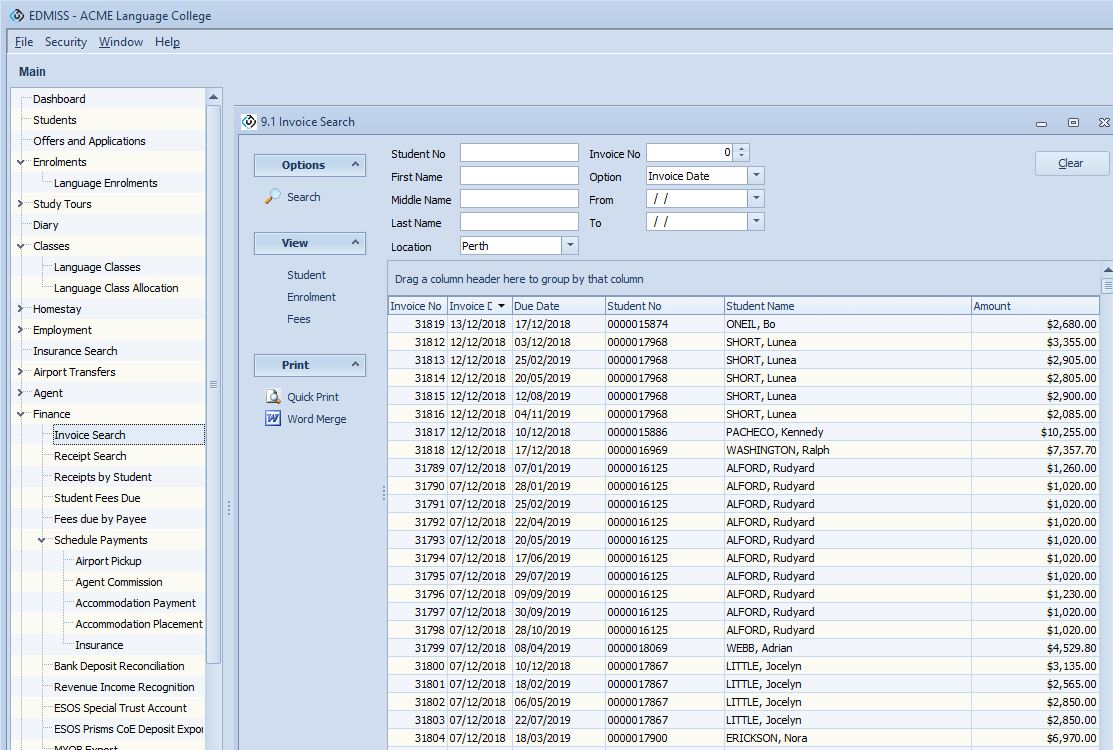

Invoice search - displaying invoice number, Invoice date, Due date, student number, student name and amount by invoice date or due date for a period and location filter and any column sort order

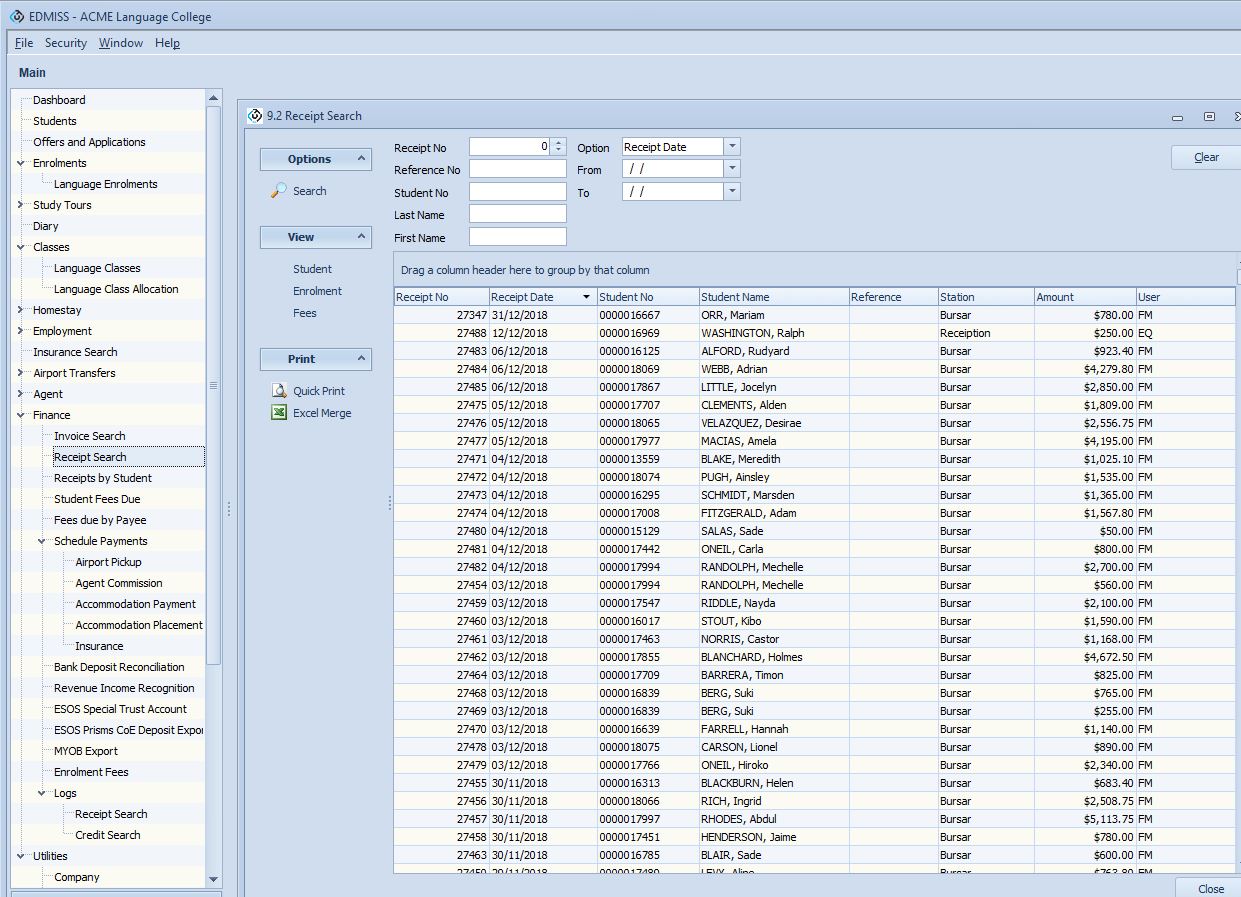

Receipt search - displaying receipt number, receipt date, student number, student name, reference, receipting station, user and amount by receipt date or reference date for a period and any column sort order

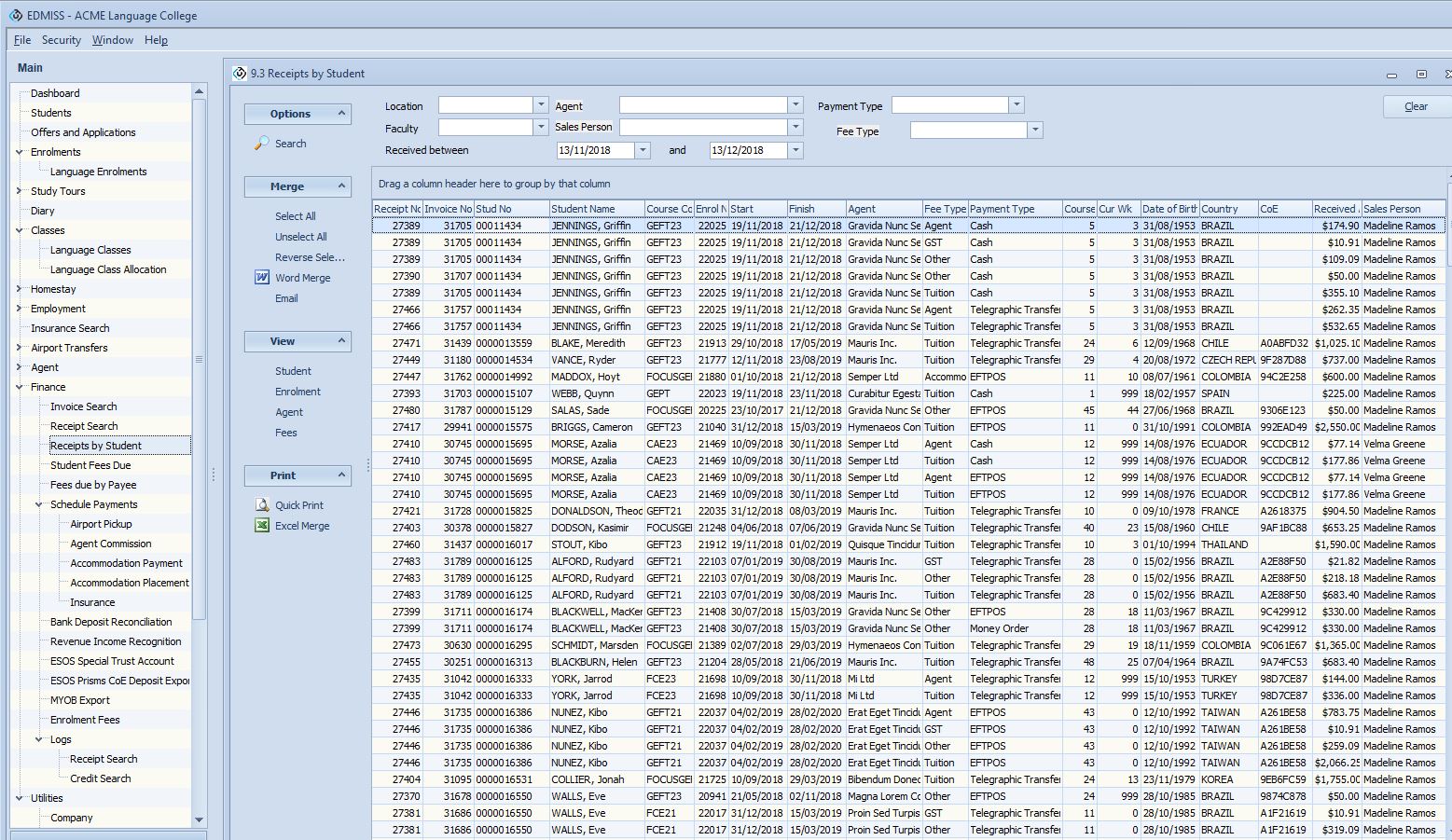

Receipts by Student - displaying receipt number, invoice number, student number, student name, course code, faculty, course name, enrolment number, start date, end date, agent, fee type, payment type, course length, current week, date of birth, country, CoE, received amount and sales person. Filters available are for location, agent, payment type, fee type, faculty and sales period received for a period

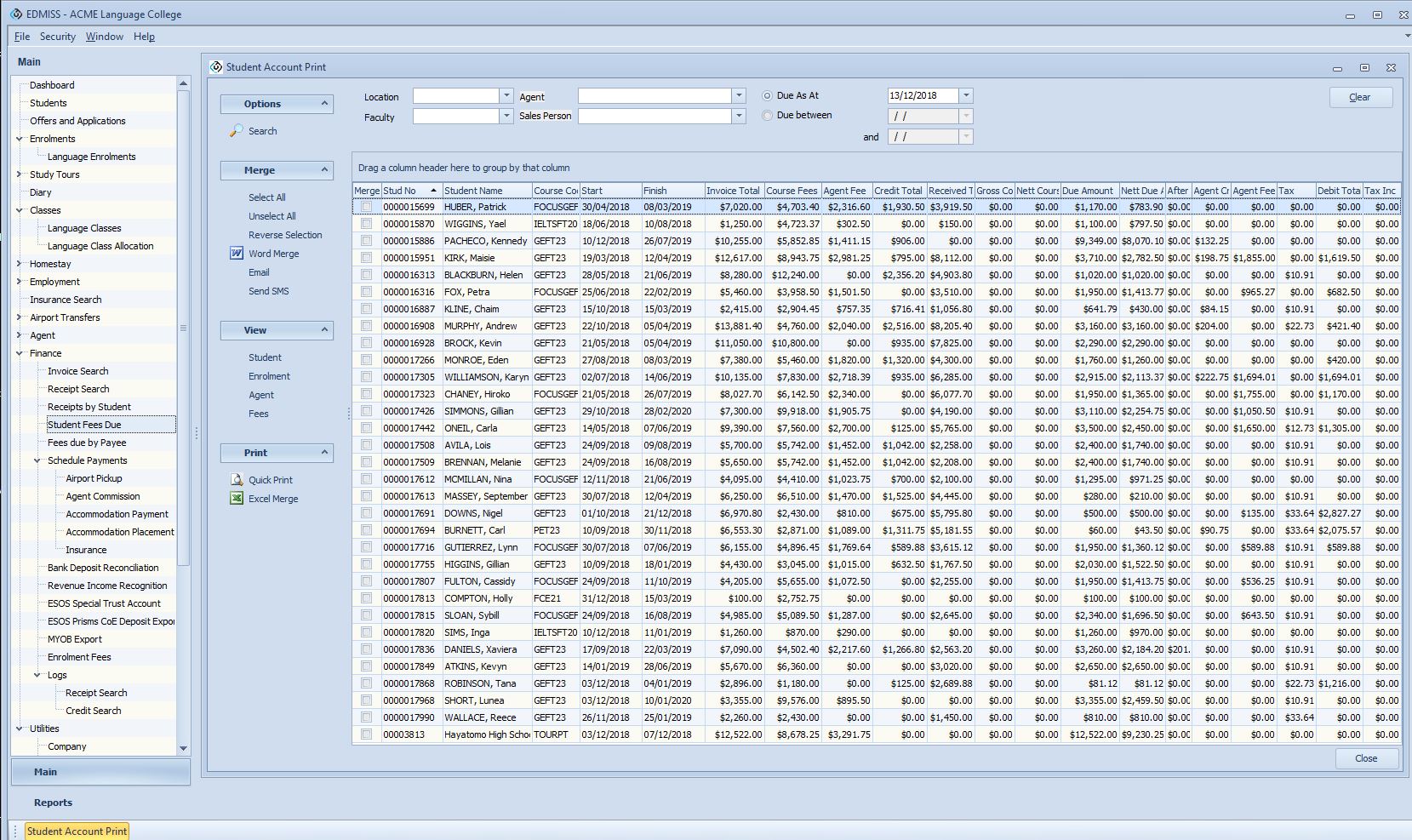

Student Fees Due - displaying student number, student name, course code, course name, start date, end date, invoice total, course fees, agent fees, credit total, received total, gross course, nett course amount, due amount, nett due amount, agent credit, tax, debt total, tax received filtered options by location, agent, faculty or sales person due as date or due between dates these fees can be merged to word using templates and emailed and sms sent in bulk

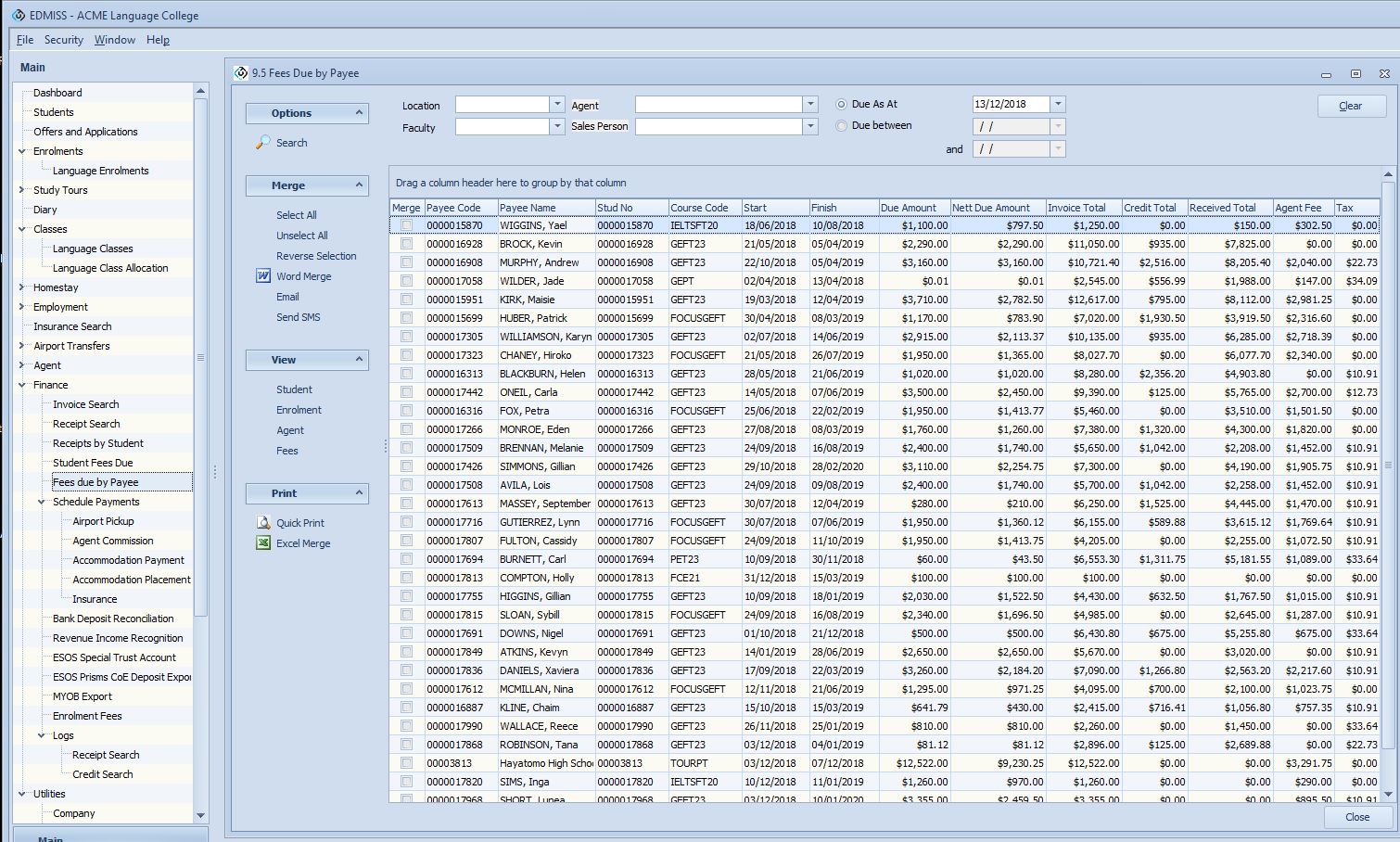

Fees due by Payee - displaying payee code, payee name, student number, student name, course code, course name, start date, end date, due amount, nett due amount, invoice total, credit total, received total, agent fee, tax, agent credit, tax filtered options by location, agent, faculty or sales person due as date or due between dates these fees can be merged to word using templates and emailed and sms sent in bulk

Schedule Payments

Airport Pickup

Agent Commission

Accommodation Payment

Accommodation Placement

Insurance

Bank Deposit Reconciliation

Revenue Income Recognition

ESOS Special Trust Account

ESOS Special Trust Account

Accounts (MYOB) Export

Enrolment Fees

Logs: Receipts, Credits

eBECAS/EDMISS - Reports - Finance

Invoices in Period

Invoices Aged Due Report

Receipts and Credits

Receipts in Period / by number

Receipts by Student Enrolment

Receipts in Period

Receipts in Period - Trust

Credits In Period

Receipts in Period - Fees

Accounts Payable

Debits in Period

Commission Report

Agents Commission Report

Financial Activity Report

Unearned Fees Report

Course Revenue Report

Revenue by Start/Booking Date Report

Homestay Revenue Report

Homestay Unscheduled Payments

The Course Revenue Report, which separately lists both the tuition and agent fees earned during a period.

Revenue by Start date. This report lists fees as revenue for students with an enrolment starting in a specified period. When generating these reports you can filter by fee type/s (tuition, Agent, Insurance, Accommodation Arrangement, Accommodation Payment, Airport Transfer and Other) to list totals by Company, Location, and Faculty etc.

You can then use these reports to determine how you want to treat each fee. Remember that the figures from these reports (Course Revenue Report and Revenue by Start date report) will change as the student enrolment changes (start date & course length changes).

Financial Activity

The financial activity report lists activity by period and contains several reports rolled into one. The report provides information that is relevant to a specified period. The financial activity report provides details (in a period) for a number of elements of eBECAS/EDMISS finance including:

Invoices

Receipts

Transferred credits (transferred from one enrolment to another)

Other credits (discounts, write-offs, etc.)

Refunds to students

Transfers out

Payments

In this report, the information provided in each column separately relates to the specified period for that column. None of the information relates to the period of the homestay or course etc.

Each report has a summary and detail option. The summary option provides sorted totals and the detail option allows you to see the student courses that the figures are from, for each column.

You can also run other reports to access more details for each column in the financial activity report e.g. Invoice in Period report.

Outstanding Fees

When an enrolment is accepted and converted to an enrolment, an invoice is created for the course fees and any other services the student requires. These fees are automatically scheduled as due on the students start date.

Alternatively, a payment schedule can be created. This will schedule part payments for any or all fees rather than having the fees due on the course start date.

Invoices Due Report

The Invoices due report lists invoiced fees that have not been paid as at a point in time. You can list fees due by a date, or outstanding based on start, current and finishing course enrolment dates.

To list all fees filtered by enrolment date (starters, current or finishers) please select the All due option. The invoiced and due fees will then be listed by Company and Location and grouped by Faculty, Course, Agent and Country and also by Fee Type and Fee. The detailed option provides details by student and you can also apply a course filter (i.e all courses or one course). You can apply a fee type filter to select all or any combination of fee types to be included in the report.

The option “detail with due date” is only included for instances where data is exported to Excel to be used in a pivot table.

For detailed information, visit this article: Invoices Due Report

Invoices In Period

(Reports – Finance – Invoices in period)

The Invoice in period report now includes the facility to filter by fee type/s (tuition, Agent, Insurance, Accommodation Arrangement, Accommodation Payment, Airport Transfer and Other). The summary provides you with a list and totals by Company and Location.

This report is simply a listing of the invoicing activity during the period entered. It is useful for measuring admissions activity and as an indication of future revenue. However it does not include any credits within that period and as such may overstate the sales position of the business.

Unearned Fees

The unearned fees report is what should be used to calculate the financial position of the student accounts for the services each student has requested.

The only students that will appear on this report are current or future students. Fees can be specified as either course fees, other fees or homestay fees and are earned depending on the fee type. In the report, the course cost is separated into tuition and agent costs and earned daily i.e. A 10 week course at $200 per week with 20% commission would total $1600 for tuition costs and $400 for agent fees. The daily fees would be $1600 / (10 * 5) = $32 per day for tuition and $8 per day for agent fees.

The Unearned Fee report is the most complex report in eBECAS/EDMISS. For a particular day, fees are calculated as Earned (revenue) or Unearned (held - trust). We provide several options to interpret how fees are to be calculated as earned. For the purpose of this report, if a student has completed their course, all of their fees have been earned and none remain unearned (although there may be fees that are unpaid).

The primary filter in this report is by current, past and future student enrolments.

The basis of the Unearned calculation is the fee type. Course cost (tuition and agent fee) is earned daily for the period the students are in attendance. The fees are earned in a week for 5 days only, Monday to Friday. Insurance fees, accommodation arrangement fees and airport transfer fees should all be earned on the course start date. Other fees can be marked as earned on the course start date or on the invoice date.

Homestay fees can be marked as earned when they are paid to the homestay provider or earned on a weekly basis over the length of the course. This can be overruled if you schedule your homestay payments, in which case you can mark all scheduled payments as earned. Alternatively, you can specify that you have only earned the portion, which is the difference between what is collected from the student and what is paid to the homestay provider.

If you have any questions regarding this, please first view the detailed fee breakdown for a particular student and trace them over a number of days. This will allow you to compare the fee details for different days and identify when fees are treated as earned.

The report is grouped by company & location and you have the option to group by course, agent, country and none. The last page of the report is a summary of totals for all fee types and fees.

Course Revenue

The course revenue report was previously known as the earned revenue report but was renamed to more closely reflect where the revenue is generated. The report lists and calculates the tuition and agent fees earned in a period, from the current student enrolments. The report also calculates the proportion of the original invoice that becomes discounts and write-offs.

Revenue is calculated based on the invoiced course cost only (tuition + agent fees) for a period. The calculation is based on the number of days that the student is in attendance for the period specified and takes into account faculty and student holidays.

The report groups by Company and Location, you can select to also group by either faculty, Course, Agent or Country. You can filter and select all faculties or a single faculty. You can filter and select all courses or a single course.

The summary version of this report provides you with totals for the following facets:

Number of days in a specified period

Booked days for all current students in a specified period

Tuition and agent fees revenue

Tuition and agent fee discounts and write-offs

Gross revenue in a specified period

The details version of this report shows the above information by student course enrolment.

Income Recognition

The Income Recognition report is designed to produce repeatable results regardless of changes to student enrolments. Results are stored and new values can be calculated from a pervious period.

Initially, you will enter a period of time and the report will calculate the revenue for that period based on invoiced course cost only (tuition and agent fees). This calculation is based on the days the student is in attendance for that course in the specified period and takes into account faculty and student holidays.

For detailed information, visit this article: Revenue Income Recognition Report

Topics

Invoices Reports

- Invoices Due Report — The Invoices due report lists invoiced fees that have not been paid as at a point in time. You can list fees due by a date, or outstanding based on start, current and finishing course enrolment dates.

- Invoices Due in Period Report — This report lists all invoices with outstanding amounts that fall due within the selected period.